In the world of real estate investing, many aspiring investors face the same challenge: how to grow a profitable portfolio without risking all their savings upfront. The answer often lies in one of the most powerful tools available to investors — f.

This concept, while sometimes misunderstood, is a game-changer when used wisely. Leveraging allows you to control high-value assets using less of your own capital. With today’s economic conditions shifting — especially with declining interest rates — understanding how to apply leverage effectively can make the difference betw

Let’s break down what financial leverage really means, how it works in real estate, and why now might be the perfect time to start using it.

What Is Financial Leverage in Real Estate?

At its core, financial leverage means using borrowed money to increase the potential return of an investment. In real estate, this typically involves taking out a mortgage to buy a property rather than paying the full amount in cash.

Instead of purchasing a $100,000 property outright, for example, you could use a $20,000 down payment and borrow the remaining $80,000. This strategy allows you to retain capital for additional investments while benefiting from the property’s full income and appreciation potential.

While leverage increases your exposure to gains, it also comes with the responsibility of managing debt. That’s why it’s crucial to understand how to leverage safely and strategically.

Why Leverage Is a Powerful Tool for Investors

Here are the main benefits of using financial leverage in real estate:

- Increased Buying Power

- Leverage allows you to buy more or better properties than you could with cash alone. For instance, $100,000 in savings could be used to purchase five $100,000 properties with 20% down payments instead of just one.

- Higher Return on Equity (ROE)

- When you invest a smaller amount of your own money but still earn rental income from the full value of the property, your return on capital increases significantly.

- Portfolio Diversification

- By spreading your capital across multiple leveraged investments, you reduce the risk associated with putting all your funds into one asset.

- Tax Benefits

- In many countries, the interest paid on mortgage loans is tax-deductible, which can reduce your overall tax liability.

- Inflation Hedge

- As property values and rents rise with inflation, the real cost of your debt stays the same — meaning your profit margin grows over time.

How to Use Financial Leverage Effectively: A Step-by-Step Guide

To harness the power of leverage wisely, follow these practical steps:

- Understand Your Financial Position

- Before borrowing, evaluate your income, savings, credit score, and risk tolerance. Avoid stretching yourself too thin.

- Choose the Right Property

- Look for properties that offer stable cash flow, are in growing areas, and have long-term appreciation potential.

- Use Conservative Financing

- Aim for a manageable loan-to-value ratio (LTV), typically under 80%. Avoid overleveraging, especially in uncertain markets.

- Calculate Key Metrics: ROE and ROI

- ROE (Return on Equity) focuses on the profit made from your own capital, while ROI (Return on Investment) considers the total investment, including borrowed funds. Comparing both helps measure leverage efficiency.

- Run Realistic Cash Flow Projections

- Include all potential expenses: mortgage payments, property taxes, maintenance, and vacancy periods. Make sure rental income can cover your costs and still provide profit.

- Monitor Interest Rates

- Leverage is most effective when interest rates are low. Monitor trends and consider refinancing when rates drop to increase returns.

- Plan for the Unexpected

- Have a financial cushion or emergency fund to cover shortfalls or unexpected repairs.

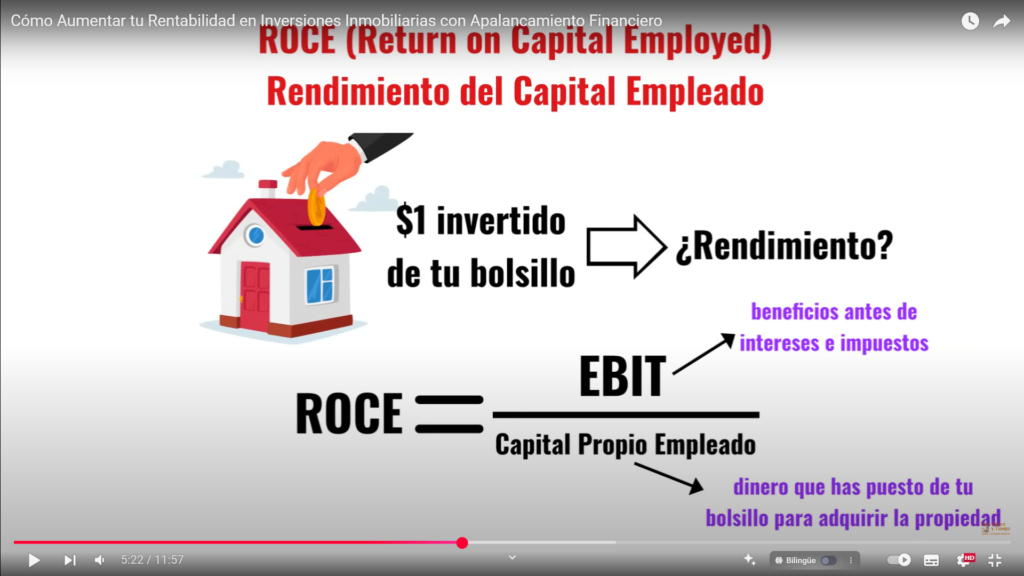

ROE vs. ROI: Understanding the Key Investment Metrics

Two critical metrics for evaluating leveraged investments are:

- ROE (Return on Equity)

Measures the return on your own invested capital.

Formula: EBIT (Earnings Before Interest and Taxes) / Equity Invested Example:

You invest $40,000 into a property that produces $2,000 in annual profit before interest and taxes.

→ ROE = $2,000 / $40,000 = 5% - ROI (Return on Investment)

Measures the return on the entire capital used, including borrowed funds.

Formula: EBIT / Total Investment Cost Example:

If the property cost $200,000 and generates $12,000 annually,

→ ROI = $12,000 / $200,000 = 6%

What’s the key takeaway? While ROI gives a broad view of total performance, ROE highlights the efficiency of your personal capital, which is where leverage truly shines. In many cases, your ROE will be several times higher than ROI when leverage is used effectively.

Expert Tips to Use Leverage Safely

- Avoid Bad Debt: Only borrow to purchase income-generating assets, not liabilities.

- Stress Test Your Investment: Ask yourself: “What if interest rates rise?” or “What if rental income drops?” Prepare for worst-case scenarios.

- Review Financing Options: Work with mortgage brokers or banks to find the best loan terms for your investment strategy.

- Reinvest Smartly: Use profits or equity from leveraged properties to finance future acquisitions.

Financial leverage isn’t just for seasoned investors — it’s a scalable strategy that can work for beginners who understand the basics. Especially now, as interest rates begin to decline globally, the opportunity to leverage wisely has never been more timely.

Used intelligently, financial leverage lets your money go further, your portfolio grow faster, and your financial goals become more attainable. But like any tool, it must be handled with care. Focus on building cash flow-positive properties, tracking your metrics, and always planning ahead.

If you’re ready to take your real estate investing to the next level, consider how you can start leveraging — not just money, but knowledge — to build lasting wealth. Your future portfolio will thank you.

Start now. Explore your financing options, run your numbers, and take action toward financial freedom through real estate.

you may be interested:

How to Secure High-Yield Term Deposits in 2025: The Smart Investor’s Guide Beyond Traditional Banks