Many investors started the year by putting their money into fixed-term deposits, also known as CDTs (Certificados de Depósito a Término), attracted by high interest rates. But what happens when those rates start to drop? That’s exactly what happened to me. I initially locked most of my CDTs for short periods, thinking only about quick returns. Soon, interest rates offered by traditional banks began to fall—fast.

If you’ve found yourself in the same boat or are just starting to explore safer, higher-yield investment options, this article will walk you through a strategy that helped me take advantage of better rates while ensuring security and flexibility. The key? Looking beyond the big banks.

What Are CDTs and Why Are Rates Falling in Traditional Banks?

CDTs are fixed-term deposit products offered by financial institutions where your money earns a fixed interest rate over a set period. They’re known for being low-risk and relatively stable investments.

The catch in 2025 is that major banks no longer need your money as urgently. Large institutions with vast client bases already have enough capital, so they’re offering lower interest rates. This is a basic principle of supply and demand: the more clients a bank has, the less incentive it has to offer competitive rates to attract deposits.

Smaller banks and growing financial companies, on the other hand, are still hungry for capital—and that creates a golden opportunity for savvy investors.

Why Small Financial Institutions Offer Better CDT Rates

When smaller financial entities need to grow their portfolio, they attract investors with higher interest rates. The key takeaway? These aren’t necessarily unsafe options. Many of these institutions are registered with Fogafín, Colombia’s deposit insurance fund, which covers up to 50 million COP per entity.

This means that with proper research, you can safely invest in these high-yield CDTs. A tool I discovered—Mejor CDT, a website and app—made this process far simpler and safer than expected.

Top Benefits of Using Mejor CDT to Invest in CDTs

Here are five major advantages I discovered using the Mejor CDT platform:

- Access to the Best Rates Across Institutions

Mejor CDT compares rates from both traditional and alternative financial entities, helping you easily identify the most competitive offers in real-time. - Security Through Fogafín Verification

The platform clearly indicates whether an institution is Fogafín-insured. You can also cross-check directly via the official Fogafín website for peace of mind. - Streamlined, Fully Digital Process

Creating a CDT online through Mejor CDT takes only 15–20 minutes, provided you have your documents ready. Once registered, future investments are even faster. - No Hidden Fees or 4×1000 Tax on Withdrawals

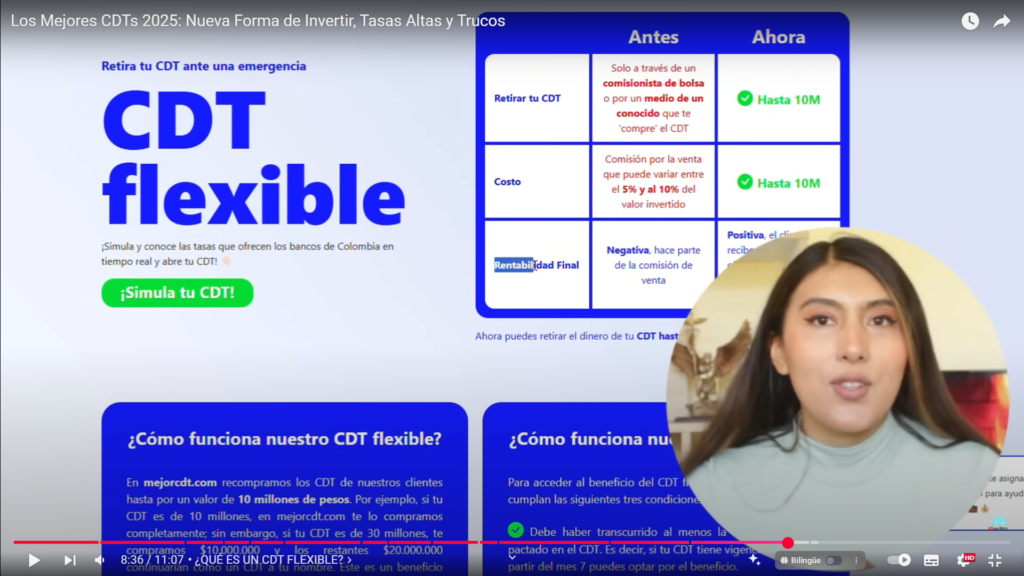

When your CDT matures, your payout is returned without the dreaded 4×1000 tax, saving you money compared to many traditional options. - Options for Flexibility and Emergencies

Mejor CDT offers a Flexible CDT that allows partial withdrawal in emergencies, and a Rechargeable CDT feature that lets you add funds over time for compound growth.

Step-by-Step: How to Open a High-Yield CDT Through Mejor CDT

- Visit the Mejor CDT Platform

Use Google to search “mejor CDT” and access their official site. You’ll see a CDT simulator with the best current offers. - Choose Your Term and Amount

Input your desired investment period (e.g., 12 months) and amount. The platform will show the top institutions and their rates. - Verify Fogafín Insurance and Ranking

Check if the selected institution is insured and review its risk classification. Even ratings with A-, A, or A+ are considered safe. - Complete Your Online Registration

Submit your identification and personal documents through the platform. This only needs to be done once. - Transfer Funds Securely

Funds are typically transferred to an enterprise collection account at a traditional bank like Bancolombia or Banco de Bogotá. This ensures your money goes directly to the institution offering the CDT. - Receive Confirmation from Deceval

Once processed, you receive a certificate from Deceval (Colombia’s securities administrator), verifying your CDT is legally registered. - Track and Manage Investments via the App

Use the Mejor CDT app to view, recharge, and organize your CDTs based on dates and amounts.

Additional Pro Tips to Maximize Your CDT Strategy

- Stagger Your Maturity Dates: Avoid receiving all interest in the same month to prevent exceeding one monthly minimum wage in returns, which would trigger mandatory social security contributions.

- Use the Rechargeable Feature: Gradually grow your investment while maintaining a single maturity date—ideal for disciplined savers.

- Always Check Classification: Ratings such as A-, A, or A+ differ only slightly. Don’t be alarmed by the plus or minus—they simply indicate where the institution falls within the category.

- Leverage Virtual Signature and Transfer Tools: Skip paperwork, lines, and branch visits. Most processes, including signing and transferring, are now digital and seamless.

Ready to Take Control of Your Savings?

Investing in CDTs through platforms like Mejor CDT isn’t just about chasing high returns—it’s about making smarter, safer decisions that align with your financial goals. While big banks may no longer offer attractive interest rates, smaller institutions—backed by insurance and streamlined by technology—provide the flexibility, convenience, and profitability that traditional banking often lacks.

Take 20 minutes today, explore the best CDT options available, and start building a more strategic, secure investment portfolio for your future. Your money deserves to work harder—and now it finally can.

you may be interested: